What does my bill from customs consist of as it is expensive?

Since the UK left the EU my customs invoice for imports into the EU from the UK looks more expensive, but is it really? Here are two examples to help explain your customs charges. One for a VAT registered business and one for a non-VAT registered business.

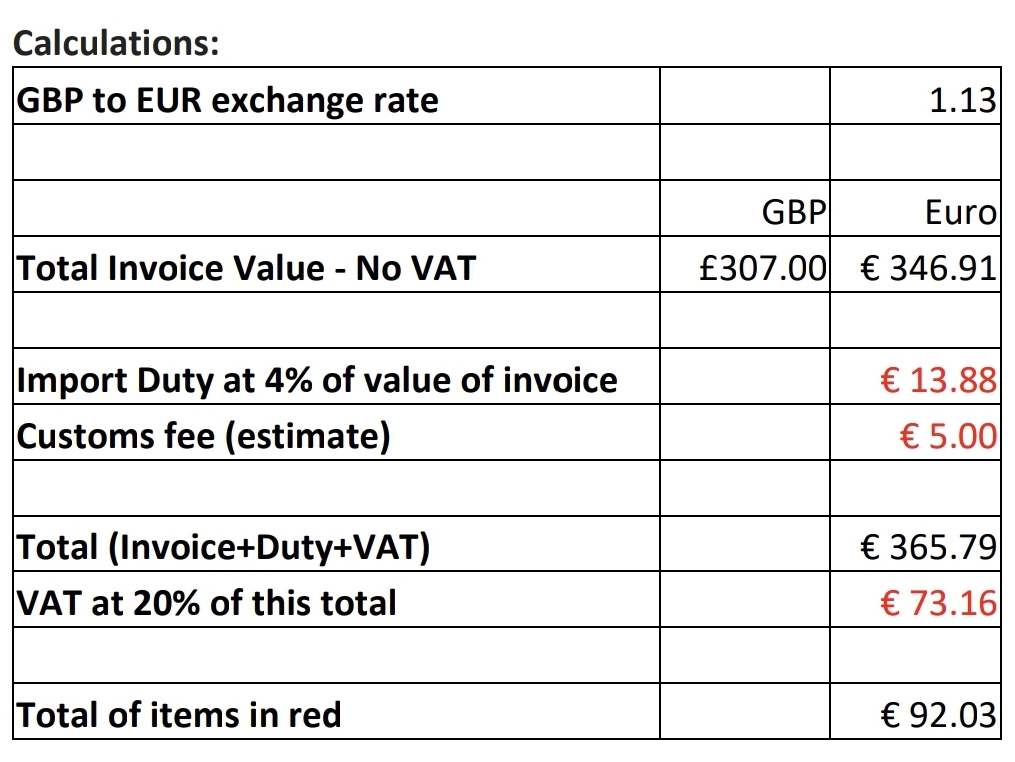

Example for an EU business that is VAT registered.

Assumptions for this example:

- The EU customer has a valid VAT number.

- Titanium or Surgical Steel Body Jewellery items on the invoice. Duty is 4% on these items.

- The total invoice value from TDi Body Jewellery is £300

- The exchange rate for GBP to EUR is 1.13 (this will vary)

- The fee charged by customs is € 5.00 (this may vary)

- The VAT rate in the EU country is 20%. (This will vary in some EU countries)

In this example, the total that must be paid to receive your package is € 92. The calculations are below, but let me explain in words first.

- The charge of €92 is a mixture of Duty, Customs fee and VAT.

- Most of the €92 charge is VAT (€73). This should go on your VAT return to claim back against your sales VAT.

- The extra fees are the duty and the customs fee €13.88 + €5.00 = € 18.88

Yes, but what would I have paid before Brexit?

Same assumptions as above.

- It was simpler. You would pay for the order and you would receive it.

- Total £307.00 (€ 346.91).

- You would need to pay the VAT (20% of € 346.91) € 69.38 as part of your normal VAT bill. So approximately the same VAT but no duty or customs fee.

- Brexit made this a little slower and a little more expensive. Sorry.

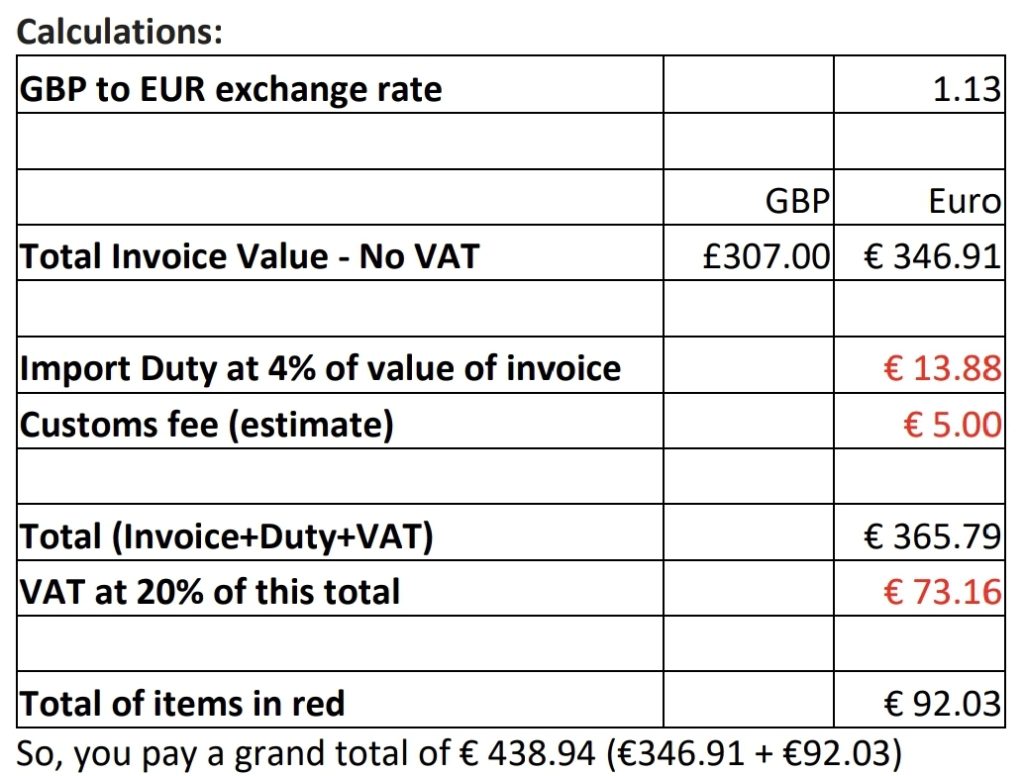

Example for an EU business that is not VAT registered.

Assumptions for this example:

- The EU customer does not have a valid VAT number.

- Titanium or Surgical Steel Body Jewellery items on the invoice. Duty is 4% on these items.

- The total invoice value from TDi Body Jewellery is £300

- The exchange rate for GBP to EUR is 1.13 (this will vary)

- The fee charged by customs is € 5.00 (this may vary)

- The VAT rate in the EU country is 20%. (This will vary in some EU countries)

In this example, the total that must be paid to receive your package is € 92. The calculations are below, but let me explain in words first.

- The charge of €92.03 is a mixture of Duty, Customs fee and VAT. Most of the €92 charge is VAT (€73).

- The extra fees are the duty and the customs fee €13.88 + €5.00 = € 18.88

Yes, but what would I have paid before Brexit?

Same assumptions as above.

- It was simpler. You would pay for the order and you would receive it.

- But, VAT would need to be paid to TDi Body Jewellery before the order was sent.

- Invoice total including UK VAT at 20% became £368.40 (€ 416.29).

- So, similar amounts. €416 before Brexit, €439 after Brexit.

- Brexit made this a little slower and a little more expensive. Sorry.

Example for an Overseas Business that is not in the EU.

Brexit has made no difference. As before, your TDi Body Jewellery invoice will not include VAT. As before, you will need to pay duty, a customs fee and VAT before you can receive your package.